A/X Growth Portfolio 2021

By Roy Philipose

-----------------

The A/X Growth Portfolio is an investment model run by Roy Philipose.

------------------

S = AC < MP

Success equals average cost being less than market price.

------------------

Investor

An investor's role is to multiply capital.

There are three steps:

- Identify assets that can increase in value.

- Allocate funds for purchase or exchange.

- Manage investments for gains.

-----------------

Dec. 21, 2021

Uncertainty, TipRanks, and Year End

There has been a major correction going on since November. Certain over-valued stocks have been hit to more right-sized valuations. The portfolio took some hits in certain names, such as Moderna. The Omicron variant is in full swing and may cause issues within the economy. Stocks prices may stay depressed. I will continue to stay long, but asset allocate because I have no choice.

The economic growth is not really there. I see 2-3% GDP growth as pitiful, especially when the U.S. prints so much money. We are experiencing stagflation where prices rise but growth does not rise in proportion. Inflation is easily around 10%. The price of goods will continue going up in 2022. Inequality will continue to be an economic and social issue.

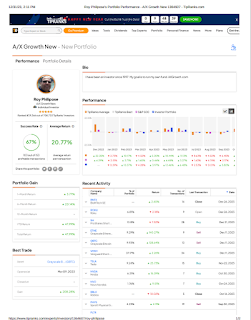

On TipRanks, I have tried to asset allocate and move the majority of stocks to cash. But moving the stocks to cash does not reflect in the public portfolio, and the portfolio details are not displayed correctly. Inside the Smart Portfolio, the allocation model will look right on the inside but not be properly displayed on the outside. The past two months have been a mess as I have bought and sold securities when I don't want to. I've sent a note to TipRanks to fix. If you move to cash, that should be properly publicly displayed. There is a saying: Free has a price.

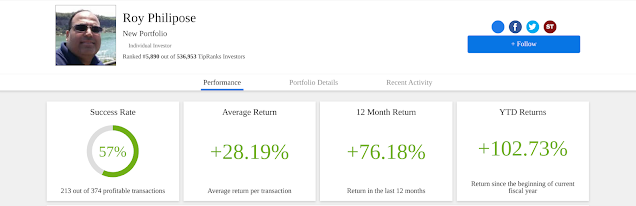

My TipRanks year-end results look good with ~ 100% YTD returns. My ranking fell off a little bit. At the peak, I was ranked 500 out of 500,000 investors with a ~150% YTD return. Currently, my ranking is at 7,000 out of 531,000 investors. This puts me at 1.3% of all investors. I look to improve that again. My goal is to be a top portfolio manager - one of the best.

A/X Growth is about "growth and preservation" of capital. I will keep the quality growth names intact while adjusting for the market environment.

Thank you.

Happy New Year!

Roy Philipose, BA

-----------------

Dec. 4, 2021

Outlook

Things don't look good. The new Covid variant is creating a cloud and causing the market to pause and sell. I hate to sell securities, but I have gone into cash. The next six months might be negative for the general market. The S&P 500 has a PE multiple of 28 when 20 is more realistic. Margin debt is also high.

Many new investors may have not been in a real crash before, but they may experience one now. I am not really one for asset allocation. I run a long-only model and I do not short. I am a share man and I don't do options. To me, capitalism works best by going long on the ideas you believe in. Warren Buffett made his money by going long-only and he rarely shorted. I will pursue the same. Because slow and steady will win the race for me. I have some decades left to make money.

How I am playing this?

Well, going forward, here is my flexible asset allocation:

Equity 30%

Crypto 20%

Cash 30%

Gold 20%

----------------

Total 100%

I will gave an updated outlook next month in January 2022.

-----------------

Nov. 30, 2021

Covid Impact and Year End

Omicron, a Covid variant, is in the news. There is a concern that this variant may slow down the economic recovery. That concern is warranted. Some industries like travel and leisure may slow down and others like online and gaming may do better. If you are really concerned, you can always reposition your portfolio.

I recently made a Buy call on AirSculpt (AIRS) at $15. The stock is down at $11. I am sitting on a nice paper loss at the moment. I don't like that. I am holding onto AirSculpt and may add some. The stock will rebound nicely when the fear of Covid is over. That's when you make your money.

This November with A/X Growth, I had a nice 9% correction. That's fine. I am well up this year ~ 130% YTD. I hate to sell, but there are times when you need to reduce your super appreciated positions, such as Upstart and Moderna. I am learning more about portfolio weight and positioning. I am good going forward.

I have been through downturns and corrections before. What else is new?

I plan to buy stocks on any major dip.

As far as I know, the world is not going to end tomorrow. Relax!

-----------------

Nov. 26, 2021

Initiate Buy on @Sprott Physical Gold Trust at $14.24

Sprott has been a leader in gold bullion management. -Leader in the Field -Insurance against U.S. Default Average your cost. Investment Report coming. Long $PHYS

Sprott has been in the physical gold business for at least ten years. I remember owning these gold shares years ago. Usually, I am not into gold, but things can change and you want to be prepared for the worst. Capital appreciation is good but capital preservation is better when times are bad. I will add PHYS to A/X Growth and keep it around 9% of the portfolio. I consider this insurance and not really an investment.

In the case of any major black swan economic event, gold may soar 10x while the rest of the portfolio may drop 90%. In that event, the portfolio will be covered. I am somewhat old school, so that is why I am adding gold today. The American financial system is not as solid as it once was before. Anything can happen.

Who knows if the U.S. gold holdings are still at Fort Knox? There is never an outside audit. Someone should look into that.

The Federal Reserve will buy financial assets out of thin air with the intention of selling them back to the market, but never do.

A/X Growth now has 18 positions.

-----------------

Nov. 10, 2021

Initiate Buy on @Expensify @ $40

#Expensify is a leader in business expense management. -Leader in the Field -Long-Term Growth -Founder CEO -Cloud-Based Platform Potential 10x. Average your cost. Investment Report coming. Long $EXFY

Expensify is a leading cloud-based expense management platform. This company looks like it is going to be much more than being about expense receipts. David Barrett, the founder, has a good vision. I am in.

I recommended it at $40 which is pretty high. The way to play this is to start a small position and average your cost.

A/X Growth now has 17 positions.

-----------------

Nov. 1, 2021

Initiate Buy on AirSculpt @ $15

-Leader in the Field

-Long-Term Growth

-Founder CEO

-Potential 10x within 10 years

Investment Report will be available soon.

Long $AIRS

AirSculpt is a leading body contouring provider utilizing less-invasive liposuction with minimal side effects and less downtime.

A/X Growth now has 16 positions.

-----------------

Oct. 26, 2021

Removal of Beyond Meat from A/X Growth

Start Price: $82.00 (Nov. 2019)

Stop Price: $94.51 (Oct. 2021)

Return: 15.26%

I hate to remove securities, but I am not happy with the direction of Beyond Meat. I may come back in once I see management change their business strategy. I want them to setup their own restaurants and become more of a healthier "fast-food" chain. I sent a message to IR.

A/X Growth now has 15 positions.

-----------------

Oct. 20, 2021

Portfolio Success

Being successful with stocks requires two things: picking the right stocks and managing the portfolio. It is not enough to pick the right stock. For example, say you purchase some Apple today @ $148. Great! You are in the game. You are a part-business owner. But there is more to it. Two weeks later, Apple declines in value 20%. It can happen. Now what do you do?

Knowing what to do is part of "managing the portfolio." If there are no fundamental reasons for the decline, you can buy more Apple stock or simply hold your position. Eventually, the stock should come back and go higher. I think this is where many investors will make their mistake. I know about this because I have done it myself. Being down 20%, you may start to panic. You may sell your position. Why? Because you don't want to take any more loss. And that might not be the right thing to do, because you will miss out on any future gains.

It is easy to buy a stock, but it can be hard to manage. What you do with a stock afterwards is more important.

For a long time, I was good at picking the stocks, but I wasn't good at managing the portfolio. After some trial and error, I am now good at managing the portfolio. Fund managers need to work more on managing their portfolio.

To be successful with stocks, you need to master both "stock picking" and "managing the portfolio." I have now mastered both components. This gives me the confidence to be successful with A/X Growth.

-----------------

Sept. 28, 2021

The stock market is ripe for a crash.

It can get ugly.

Reasons:

Debt Ceiling Debate

High Valuations

Stock and Options Speculation

High Margin Debt

Covid Delta and variants

Unknown Black Swan Event

China Property Default

Corporate and Capital Gain Tax Increase

Recommendations:

Deleverage (reduce margin)

Have cash on hand

Average Cost

-----------------

Sept. 24, 2021

My concerns on Toast IPO.

-----------------

Sept. 23, 2021

I plan to compete in the portfolio management space.

My goal is to get to $10B AUM within 10 years, after I start.

-----------------

Sept. 18, 2021

Initiate Buy on Solana @ $160

-Promising Startup -Long-Term Hyper Growth -Well-Known Crypto -Potential 10x within 5 years Investment Report will be available soon. Average your cost if price declines. Long SOL

Solana is a 3rd generation platform that promises to be the most low-cost, fastest, and scalable blockchain.

I am late in adding this one. I look away from crypto for about 2 months and this one comes out of nowhere. I should have added it like last month when it was around $40. So be it.

Normally, I don't like to add startups, but I like this one. I have five major cryptos and I don't feel like adding anymore.

A/X Growth now has 16 positions.

-----------------

Aug. 19, 2021

Removal of FAANG

Facebook, Apple, Amazon, and Alphabet (Google) have become very large companies. As an investor, you would cheer that your price of shares has greatly risen. But that rise comes at a price. These corporations are no longer companies, but countries. The CEOs act in their own best interests for their own country.

Recently, there was hearings about the continuation of Section 230. Section 230 provides immunity for social media companies. The company itself is not liable for false statements. Rather, the individual, who maybe anonymous, supposedly is. This gives Facebook and Alphabet an unfair advantage in the publishing world to be distributors of media and not be liable for it. One reason why I don't want to partner with these two companies anymore is that I have been victim to the false statements they help distribute.

Amazon has grown from a small online bookstore to a mega-online store selling literally everything. They also have a growing cloud business as well. I have decided to stop partnering with them. One reason is that their online list of products usually features some low quality knockoff with supposedly great reviews. Also, their taxation policy is somewhat suspect. They have grown simply too big. There is no reason Amazon or the other mega-caps can't get into all of the business industries.

Apple is a company I respect, especially when Steve Jobs was running it. Tim Cook has done a fine job continuing in the spirit of Jobs. But Apple has become an empire, like the other mega-cap companies. They received special tax treatment to bring overseas money back to the U.S; money that could have been useful to sponsor society, so that more people could be better off. They have taken on massive debt to buy back their stock. Like the other mega-caps, their effective tax rate is low. I am not interested anymore.

Netflix started as a small online content distributor and has become the largest online content distributor. They even make their own content. But they are in a very competitive business with no real barriers to online distribution. Competitors are doing their own distribution and don't need Netflix anymore. Recently, Netflix content looks stale. Netflix and the other mega-caps can still grow, but I have lost interest.

Normally, when I add a company or crypto to A/X Growth, that is a permanent decision. I generally like to keep it that way. But there will be rare times, when I remove a security for various reasons.

Money isn't everything in life.

Thank you.

------------------

Aug. 8, 2021

Stock Ratings

I have "Buy" ratings on all of my A/X Growth Stocks. I do not have "Sell" or "Hold" ratings. I see no point in upgrading or downgrading a stock, just because of the valuation. The valuation of securities can fluctuate. In traditional finance, the stock analysts will upgrade and downgrade all of the time. I don't do that. To me, that is inefficient. Either you like a stock or you don't. Stocks are either a Buy or they are not.

------------------

July 21, 2021

Initiate Buy on AirBnb @ $139

-Favorable Risk/Reward

-Long-Term Growth

-Well-Known Brand

-Potential 10x within 10 years

Investment Report will be available soon at AXGrowth.com

Long ABNB

-----------

-Favorable Risk/Reward

-Long-Term Hyper Growth

-Necessary Crypto Platform

-Potential 10x within 5 years

----------------

July 19, 2021

Reports

Going forward, I will try to update the research reports annually, once the annual reports come out. Writing reports forces you to do the research.

--------

Removal of FAANG

I have decided to remove:

- Apple

- Amazon

- Netflix

- Alphabet (Google)

These companies have had a fantastic run, but I am not interested in covering them anymore. They were barely part of the portfolio anyways. I can only follow so many companies so well. FAANG can still continue to grow.

Personally, I will still use their products. But I am satisfied with what I have in the current portfolio. I will continue to evaluate new growth ideas and add them accordingly.

-----------------

July 16, 2021

Crypto

Crypto is the next big thing and represents the next-generation of value. Once you realize that, you will acquire as much as you can. Just be prepared for volatility. Eventually, crypto is going to boom.

I have included some crypto in the A/X Growth for that reason.

--------

Investor

Investors invest in three stages:

- Early-stage

- Mid-stage

- Late-stage

What stage to invest in is entirely up to you. You can invest in one stage or in all three. Each stage has its own risk/reward profile. You have to invest in the stage that is comfortable for you.

Early-stage: High risk/high reward - 100/1000x returns - Private Equity

Mid-stage: Medium risk/medium reward - 10/100x returns - Private Equity/Public Equity

Late-stage: Low risk/low reward - 10x returns - Public Equity

I am very comfortable being a late-stage investor; I started that way. I usually come in after the fact, after the initial risk has subsided. I can expect at least 10x returns or more.

Investments in A/X Growth are typically in the late-stage.

--------------

May 24, 2021

Investor

Becoming an investor is a path one should take, if one needs to take it.

Investing is not easy. It is a process that one learns with study, trial and error. Investing is not for everyone. If you are comfortable investing in mutual funds, then continue doing so. If you want to earn more, then you need to learn more. I made a video about becoming an investor, because for some of us, we need to follow a different path. Investing gives you a different insight into the things around you.

There are resources (books and online materials) out there to help you get started. I included them inside the description of my YouTube video "Becoming an Investor." All investors should build out their own library. My library is small, as I tend to think more than read.

All my learning is self-taught. I never learned investing in school. I do recall something about Present Value and Future Value. But that's it. Investing needs to become a major. We need more investors. We need more people to understand what capital really is and what we can do with it.

My end goal is to become a portfolio manager, a professional who manages investments. Like I have said before, I am highly confident that I can beat the market average. If I couldn't, I would not pursue this career. My performance goal is to attain sustainable, above-average gains.

How I manage the TipRanks model is how I plan to manage my future fund. So far, so good.

-------------

May 23, 2021

Crypto

When markets crash 50%, that is an investor's dream. Why? Because this is when the "good stuff" is marked down. This is like a Macy's One Day Sale. I think they used to have them on Wednesdays. Who doesn't like 50% off?

These are the times when you make your money. These are the times when you have to put up or shut up. These are the times when you need to be greedy when others are fearful, as said by Warren Buffett.

I am holding and adding. I have been through crashes like this before. Usually, I would sell because prices have dropped. Later, the markets would recover and go higher, and I would miss out. I am not missing out this time. I know better.

Crypto was in a bubble and needed to correct. That's okay. I'm still in.

------------

Dogecoin

I have taken a neutral position on Dogecoin. Dogecoin would have to become more stable and a solid opportunity before I would potentially consider it for A/X Growth.

-------------

May 21, 2021

Crypto

Crypto is going through a correction phase. Prices have dropped an average of 50% from recent highs. I have always said to go long and average your cost. I will never recommend short-term trading or using leverage, such as margin or options. It is far too dangerous. Leverage seems to work until it doesn't.

What is crypto?

Crypto is basically Fiat 2.0. It is a layer that rides on top of normal currency.

Crypto is a newer and better version of fiat. It is a currency that is introduced by the marketplace and not officially authorized by the government. Therefore, crypto is subject to potential cancellation. There is a degree of risk in owning crypto, as it is a highly volatile asset. Until crypto becomes fully authorized, I would recommend owning no more than 20% in your overall portfolio.

I firmly believe in what crypto represents, and that is why I have added and kept crypto in the A/X Growth portfolio.

--------------

May 19, 2021

Crypto

Crypto is a better way to store, exchange and account for value.

World governments such as China and India are banning crypto. I see it as not fully understanding what crypto might be. When you fully don't understand something, you usually say no to it or discredit it. That's what I see here. US can take a different direction. They can start buying the marketplace cryptocurrencies and become the biggest holder of crypto assets. Whether you like it or not, crypto is here to stay. World governments should try to understand this. Then they will start buying instead of banning crypto assets.

----------

Trading

Trading stocks is for fools. If you don't believe me, you will. I know this because I was a fool twice. If you trade, you will become a fool. You will lose your money. I don't care if you trade $100K or $100M, you will lose your money. I have saved many press clippings of hedge funds who have gone under. They were traders who tried to beat the market, only to have the market beat them.

A/X Growth is all about long-only ideas; ideas of companies and cryptos I believe in long-term. I don't trade like a hedge fund trying to maximize gains and minimize losses. That trading style is bogus, and won't result in much. Warren Buffett was all about the long-only. He knew the value in that strategy and so do I.

--------------

May 3, 2021

Crypto

Crypto, short for cryptocurrency, is a better way to store and exchange value - worldwide. It is better because it operates on a blockchain, a decentralized and distributed ledger that is generally secure, scalable, open and transparent.

|

|

Cryptocurrency is a new digital marketplace currency that rides on top of any government fiat currency. Fiat currency is just currency that is dictated by the centralized government. It is backed up only by the confidence in the government. Crypto is backed up by confidence in the blockchain. Two reasons why crypto is preferred over fiat: worldwide portability and less inflation, which makes crypto more valuable.

But things can change and reverse. Ethereum is becoming the new gold and Bitcoin is becoming the new silver. We will see how all this plays out. The two smaller startups, Polkadot and Cardano, will play a role in the future. My role, as an investor, is to allocate, manage and multiply capital. So I will make moves accordingly. I am pretty sure all of the four cryptos will increase in value. In time, I may have to remove one or two of them. It's too early to call definite winners. Though, my early calls on Bitcoin and Ethereum have done well.

Dogecoin

Dogecoin, which has risen to $.50 from $.05 in about a month, has become popular. I usually don't speculate and I only recommend people put in about 10% of their available funds in such ventures. I have a specific investment strategy that has worked out for me over the many years and I intend to stick to it. I am pretty sure Dogecoin will eventually have a massive crash and many newbie investors will learn the hard way. Dogecoin is going up mainly for technical reasons because fundamentally there is not much there. Retail investors are buying in. I am not.

--------------

May 2, 2021

I am adding Cardano to the A/X Growth Portfolio @ $1.34.

This is a potential 10x return.

Cardano, a startup, is considered to be a 3rd generation blockchain platform which seeks to improve upon Ethereum. Cardano's token is ADA and available on Coinbase.

You have two major players: Bitcoin and Ethereum, and two up-and-coming players: Cardano and Polkadot. The crypto space is dynamic. You have to watch it to see who is going to win - I have ideas. It is better to bet on all four now and see how this plays out.

An investment report will be available soon.

Long ADA.

A/X Growth now has 19 positions.

--------------

When I start a position, it is usually small. Generally, I will wait for developments before I increase the position. If I bought too high, I will average down my cost price. Why? Because I know the asset will be worth much more in the future. As the price increases, I may average up my position. Averaging should work for you both ways, up or down. Again, you have to make sure you are buying the right appreciating assets. As long as your average cost is less than the market price, you are in good shape.

Apr. 22, 2021

Ethereum is now the biggest crypto holding in A/X Growth.

I have reduced the Bitcoin position.

I will the update the Ethereum report shortly.

--------------

Apr. 19, 2021

I am late in writing and updating the investment reports I put out. There are 18 positions that I cover. (That is a lot of time-consuming work.) I am not an analyst. (That's not what I really do.) My research is simple and not sophisticated. I can look at a business or idea and tell if it has value and additional future value. I do that thinking in my head and after doing some simple research, decide to buy. I am good at that decision making.

A portfolio manager has to decide what securities to invest in and what price to buy in.

Assets are assets. So over time, the value of the asset will increase. Just make sure you pick the right asset.

I am confident in all of my picks. If the stock market closed today and stay closed for the next 10 years, my picks would do fine. I am highly confident that I can beat the market average. You should be able to vouch for all of your picks. What is in your top ten is important.

I look forward to the day when I am writing a simple annual report or a bi-annual report on stocks. Writing and updating 18 reports is something that I have little desire to do. I will be adding more securities over time, so writing one or two reports will be better for me.

I look forward to the day when I am running a public growth fund with the stock ticker and all - that is my dream. I know I can create value for others.

--------------

Apr. 14, 2021

I am adding Coinbase to A/X Growth @ $365.

This is a potential 10x return within 10 years.

I like the fact that there are 6 Million Monthly Transacting Users (MTUs) that can grow to 60 Million MTUs worldwide. If the price of the stock goes down, buy more.

Investment report will be available soon.

A/X Growth now has 18 positions.

Long COIN

--------------

Mar. 10, 2021

I am adding Roblox to A/X Growth @ $63.

Potential 10x.

I like the fact that there are 30M+ Users that can grow to 300M+ Users.

Investment report will be available soon.

Long RBLX.

A/X Growth now has 17 positions.

--------------

Feb. 22, 2021

I am late in the writing the research reports.

I rather just manage the securities.

I am good at doing that.

--------------

Feb. 4, 2021

Stocks represent ownership in a company.

When you buy a share, you've become a part-owner.

Now answer this...

What do you do when your stocks drop 50%?

1) Do you sell?

2) Do you hold?

3) Do you hold and buy?

You need to think about this before it happens.

Remember, Success = AC < MP

--------------

Jan. 16, 2021

Happy New Year!

Man! What a year in 2020!

In 2020, demand exceeded supply and share prices rose across the board.

A/X Growth had a good year.

----------------

New Addition to A/X Growth:

I am adding Polkadot @ $16.

Polkadot is a network protocol that allows full interoperability, scalability and security with other blockchains. Polkadot, a startup, is similar to Ethereum but offers more features and customization that developers would like. Polkadot's token is DOT.

In 2021, Polkadot is a mid-stage startup and on its way to the growth stage by 2022. Normally, I wouldn't recommend startups, but I feel good about this one. If DOT drops in price, buy more.

DOT is available on Kraken, and soon should be available on Coinbase.

Investment report is coming soon.

A/X Growth now has 16 positions.

© Copyright A/X Growth Roy Philipose 2021.