A/X Growth Portfolio 2022

By Roy Philipose

© Copyright Roy Philipose 2022. All rights reserved.

--------------

The A/X Growth Portfolio is a superior investment model run by Roy Philipose that delivers sustainable above-average market returns.

2022 Performance:

A/X Growth: -8% (estimate)

S&P 500: -19.95%

-------------

Disclaimer:

Investments may lose value.

-------------

Economic Data

- FINRA Margin Statistics

- Consumer Price Index

- Michigan Consumer Confidence

- US Consumer Confidence

- US CEO Confidence

- Unemployment Rate

- Gross Domestic Product

- S&P 500 PE Ratio

- AAA Average Gas Prices

- ISM Report on Business

-------------

Resources on Investing

By Robert Kiyosaki

1) Rich Dad, Poor Dad (Money 101)

2) CashFlow Quadrant (Money 201)

3) Rich Dad's Guide to Investing (Money 401)

By Peter Lynch

1) Learn to Earn (Investing 101)

2) Beating the Street (Investing 201)

3) One up on Wall Street (Investing 202)

By Philip Fisher

1) Common Stocks and Uncommon Profits (Investing 301)

By Warren Buffett

1) The Warren Buffett Way by Robert Hagstrom (Investing 302)

2) Berkshire Hathaway Annual Letters

By Chamath Palihapitiya

1) Social Capital Annual Letters

-------------

Investing

I subscribe to a long-only model. That is the only model I recommend and that is how I invest. Warren Buffett subscribed to the long-only for the past 55 years and he has literally outperformed everyone.

(Sept. 2022) I have recently gone long/short. I will mostly go long and occasionally go short.

In order to be a good investor, you need to have a vision (the ability to see the future). The hard part is finding the few real investment opportunities among the many fake ones.

-------------

Crypto

Cryptocurrency is the next-generation global accounting system. Crypto is still in the early startup phase.

-------------

Startups and IPOs

Startups and IPOs are not suitable investments for newer retail investors.

-------------

A/X Growth

The A/X Growth Portfolio will be rebalanced at the opening on the date provided in the box.

-----------------------------------------------------------------

-----------------------------------------------------------------

December 12, 2022

-------------

November 29, 2022

-------------

-------------

November 22, 2022

-------------

November 21, 2022

-------------

November 16, 2022

-------------

November 13, 2022

-------------

November 10, 2022

-------------

November 9, 2022

-------------

---------

October 31, 2022

--------------

October 26, 2022

----------------

October 24, 2022

-----------

October 19, 2022

------------

October 18, 2022

----------------

October 14, 2022

--------------

October 13, 2022

--------------

---------------

September 22, 2022

----------------

September 21, 2022

-------------------

September 20, 2022

-----------------

September 8, 2022

-----------------------

September 6, 2022

-------------------------

September 6, 2022

Proshares Short S&P 500 ETF

---------------------

September 2, 2022

---------------------

August 27, 2022

-----------------------

August 12, 2022

--------------------

August 9, 2022

--------------------

August 9, 2022

-----------------------------

August 7, 2022

-----------------------------

July 31, 2022

-----------------------

July 24, 2022

----------------------

July 20, 2022

----------------

July 5, 2022

Crypto prices have dropped recently and reflect better entry points.

-----------------

June 12, 2022

I have increased Gold (PHYS) to 50% and have reduced Cash to 30%. In Equity, I have increased Tesla to 4% and have replaced Coinbase with Expensify. The portfolio will be rebalanced on the opening of June 13, 2022.

-------------------

May 25, 2022

Investment Outlook

I expect the stock market and crypto market to remain flat to negative for the next 3-6 months.

Investment Strategy

I am light on equity and crypto and heavy on gold and cash. I will continue this asset allocation for the next 3-6 months.

A/X Growth

The A/X Growth Portfolio is positioned to handle the current negative market environment and is ready to grow when a more positive market environment returns.

A/X Growth Performance

I expect a 20% loss or less for 2022. I have to manually calculate performance based on overall allocation held at specific times.

-----------------

May 20, 2022

----------------

- Upstart UPST

I am adding back Upstart @ $42.

After confirming with Investor Relations, Upstart's business model should be back to normal within a quarter or two. I just remembered about their $400 million stock buyback they announced after Q1. Initially, I thought it was only a $40 million buyback. I am pretty sure management is buying back stock this quarter.

A/X Growth now has ten positions.

------------------

May 19, 2022

Removal from A/X Growth-------------

- BioNTech BNTX

Removed May 18, 2022.

I have removed BioNTech and Moderna because they haven't addressed the 14,680 deaths that have been associated with their Covid vaccine. They need to acknowledge, apologize, and compensate the victim's families. Otherwise, I don't have any issue with their business. These companies have made billions off their Covid vaccine and have no general liability for it.

Source: VAERS

A/X Growth now has nine positions.

-----------

May 18, 2022------------------

May 15, 2022

Capital Preservation

2022 will go down as a year of "capital preservation" and not "capital appreciation." Normally, fund managers are looking for capital appreciation. But, this year, in 2022, capital preservation is what you want to seek. If you were able to preserve capital or take a small loss, you are the winner.

Margin Debt

Margin Debt is still high at $772 Billion, as of April 2022. I am still cautious about the stock market. I would like to see the margin debt go down to at least $700 Billion.

Removal from A/X Growth

- AirSculpt AIRS

- Zillow ZG

- Upstart UPST

- Moderna MRNA

- Palantir PLTR

- Expensify EXFY

I have removed these six positions as of May 13, 2022. I may reinitiate these positions at a later date. I regret not removing these positions earlier in the year when they showed breakeven or an investment gain. I thought about removing them but I waited too long, and now, I've taken a loss. I wrongfully added some of these companies at a very high valuation.

A/X Growth now has ten positions.

Asset Allocation

The A/X Growth Portfolio has been updated and reflects all positions.

Performance

Performance is calculated by the previous day's closing price and the weight of the individual position. For 2022, I am estimating a 20% or less overall loss for A/X Growth.

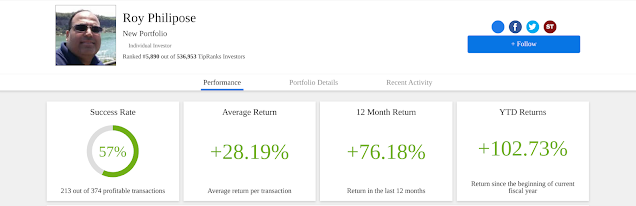

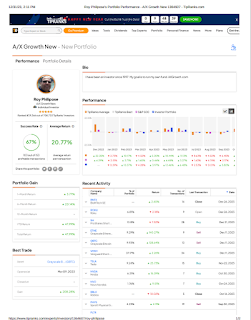

TipRanks

The TipRanks site doesn't exactly reflect the current A/X Growth performance for 2022. For example, the site states that I'm down 45% YTD. That is not accurate. As I said previously, the site does not fully integrate all the asset allocation classes. But the site is good to use and I'll try to see what I can do with it for this year.

I need to manually calculate my A/X Growth performance this year, which I estimate should be a 20% loss or less.

TipRanks has made some updates but it's not a full portfolio management suite yet. I have another site I plan to use when I launch my investment partnership in 2023.

Upstart

I took both a recent personal and professional loss on Upstart. Whatever investment gains I've received in 2021 were somewhat reduced this year by recent losses. To see the stock go from $40 to $400 and then back down to $40 is tough. But I have seen this before. Next time, I will trim my highly increasing position much more.

I sold most of my Upstart stock right before the earnings came out. I just had a bad feeling. The next day, the stock drops by 50%. Upstart may have some bad loans coming, but I still believe in the company.

Coinbase

Coinbase has declined significantly since the IPO when I initiated the position at $365. The current price is $60. That is an 83% loss. But since the Coinbase position is small in the overall A/X Growth Portfolio at around 2%, the recent loss has been minimal.

I believe the company will make a comeback. They have a decent investment portfolio in crypto-based startups. Coinbase is much more than just a crypto broker.

Stay Invested

Traditional investment advice states that you should stay the course. Well, that advice kicked you in the butt this year. I am glad that I shifted to cash and gold early on, but I came back to equity too soon and took a hit. I have since readjusted the portfolio allocation to play it safe with some growth opportunities.

As a portfolio manager, you have to be dynamic in dynamic times.

----------------------

May 12, 2022

Investment Outlook

Economic growth will be flat to negative this year as a stimulus package is not available for consumers. Last year, consumers had an extra amount of cash to save and spend; this year, they don't. Inequality continues to be an issue that is not being fully addressed.

Asset Allocation

The Equity portion of the A/X Growth Portfolio will consist of primary positions and secondary positions, with their respective percentages. A/X Growth's secondary positions have been at an equal percentage throughout the year.

-------------------

May 10, 2022

Investment Outlook

We have been in a bear market since November 2021. The investor sentiment is negative. Stocks have declined and may continue to do so. Institutions that borrowed so much money on margin to goose gains are now selling to avoid more losses. Inflation has to flatten out and decrease in order for the FED to stop its interest rate increases. Labor and supply chain issues will continue for the rest of the year. I don't see any short-term (6 months) positive catalysts.

Equity 20% (TSLA, UPST, A/X G)

Crypto 20% (GBTC, ETHE)

Cash 40% (Cash)

Gold 20% (PHYS)

------------

Total 100%

I am not releasing any more public Research Reports or updating them. The research will be internal.

I am not releasing any more public "Buy" Recommendations. The Recommendations will be internal.

Apr. 19, 2022

Addition:

Moderna (MRNA) @ $150

I am adding Moderna back to the A/X Growth Portfolio. The TipRanks portfolio has been updated. A/X Growth now has 16 positions.

Asset Allocation: Equity 30% (TSLA, UPST, A/X Growth) Crypto 30% (GBTC, ETHE) Cash 20% (Cash) Gold 20% (PHYS) ------------ Total 100%

----------------------

Mar. 9, 2022

Investment Outlook: Gold has been a good place to park your money since the recent crash and market volatility. Growth stocks have been down-priced to more reasonable valuations. The market will be range-bound until political stability is achieved and inflation is under control.

Asset Allocation: Equity 30% Crypto 20% Cash 20% Gold 30% ------------ Total 100%

--------------

Mar. 1, 2022

Portfolio

Two of my biggest equity positions are in Tesla and Upstart and two of my biggest crypto positions are in Bitcoin and Ethereum. I maintain a flexible asset allocation model, and I recommend you do the same.

Margin Debt

U.S. Margin debt is still high compared to recent years. I would take a cautious approach to investing in the market. I would feel more comfortable if the margin debt went back down to the $600B range.

Jan. 2021, $829B

Source: Finra

TipRanks

I continue to use the TipRanks simulation site for the A/X Growth Portfolio. I am confident by year-end, my return will be positive and outperform the S&P 500.

You can attach your brokerage account to the site and I may do so when A/X Growth officially launches.

--------------

Feb. 10, 2022

Crypto

Crypto is coming back. Eventually, the U.S will allow and regulate it. The regulation should come sometime next year.

I don't take positions in startups anymore. So the only two established cryptos I recommend are Bitcoin and Ethereum. Bitcoin is disrupting gold as the preferred store of value and Ethereum is becoming the crypto payment standard. I see both existing and more valuable years from now. The institutional money is backing both coins.

A/X Growth takes positions in established companies and cryptos only.

-------------

Jan. 31, 2022

TipRanks

My ranking dropped to 363K out of 555K and shows two stars with a YTD performance of -28.8%. That hurts. It is a good thing my return last year was 102%. I went from highly ranked to lower rank. LOL. TipRanks is good if you want to be 100% in stocks. Again, the integration of cash and funds is not properly accounted for, and my ranking took a major hit. In a normally managed portfolio, this would not have happened.

The simplest thing I could have done was to sell off all of my positions in December and then buy back much later. I will make a comeback, and by year-end, my ranking will be improved and my return will be positive. I can walk away when the going gets tough, but I choose not to. I chose to fight and win.

Asset Allocation

Equity 30%

Crypto 10%

Cash 10%

Gold 50%

------------

Total 100%

Your asset allocation should be flexible.

Capitalism

Real capitalism will always win in the end. The companies that sell a product while helping society will do better than the companies that just sell a product.

----------------

Jan. 23, 2022

Asset Allocation

Equity 10%

Crypto 10%

Cash 10%

Gold 70%

------------

Total 100%

Outlook

This looks really bad. I have moved too late on this.

Interest rates are going back up and the Fed will stop its quantitative easing program. Margin debt is extremely high and forced margin selling is occurring. Stocks can continue to go lower. Labor and supply issues still exist.

Back on Sept. 28, 2021, I had warned about a stock market crash.

Margin Debt:

Dec. 2016, $529B

Dec. 2017, $642B

Dec. 2018, $554B

Dec. 2019, $579B

Debt average = $576B

Mar. 2020, $479B

May 2020, $552B

Dec. 2020, $778B

Oct. 2021, $935B

Dec. 2021, $910B

Source: Finra

Margin debt peaked in Oct. 2021 at $935B. The correction started in Nov. 2021. Stocks can still majorly correct.

TipRanks

My personal portfolio is doing better than the virtual portfolio I manage on TipRanks. I will have to make some adjustments just to get my public performance back. I am looking for another public investment site to use.

Crypto

I need to re-evaluate what crypto is worth.

Gold

Gold has been a good hedge over the past six months and has helped me with capital preservation. Gold shares can be purchased via Sprott Gold (PHYS).

A/X Growth

Going forward, the A/X Growth Portfolio will be more dynamic. There will be portfolio adds, increases, decreases, closeouts, and reentries.

-------------

Jan. 19, 2022

Stocks

I am glad stocks have taken a hit. There was too much excess. Many stocks were overvalued, and now they are fairly valued. This is the time to buy. I am adding to existing positions.

A/X Growth will have a minimum of 20% return by year-end.

-------------

Jan. 11, 2022

TipRanks

I am not happy with the TipRanks website. My ranking has taken a hit. My results look worse than they should be. The private site is not fully integrated with its public results and rankings. If you put your money in cash or gold shares, the public rankings and performance will ignore that. The site is free, so you take what you can get.

I will stick to what I know - managing capital.

I will continue with a proper allocation on TipRanks. I am restoring PHYS back from GLD. I have more faith in Canadian gold shares than American gold shares.

A/X Growth is about capital appreciation and capital preservation.

-------------

Jan. 9, 2022

Outlook

The S&P 500 is ripe for a correction. I consider the index an over-crowded trade.

There is a major correction going on and stock valuations are coming back down to earth. Certain securities that were highly priced are in correction mode. Many companies that went public last year in 2021 are shedding value to more normal IPO valuations. I am glad I stayed away from many of them. Just because an IPO contains a Founder Letter doesn't make it special.

You have to ask yourself:

1) Do I want to partner in this business?

2) How much should I pay?

A good number of stock names are fairly priced. On TipRanks, my performance looks worse than it is. My current 2022 YTD is showing a negative 17%. That hurts. Last December, I shifted the majority of stocks to gold (PHYS) and cash, but the ratings and rankings didn't show that properly. Whatever is shown in the internal window doesn't reflect accurately in the outside window. TipRanks is not perfect. I've sent another email to the company to make sure that gets corrected.

Just for record-keeping on TipRanks, I will substitute GLD for PHYS.

I see value in many growth stocks, so I am sticking with them. The market will eventually come back and the premium names will do better. I like the names I have. I am confident in a recovery in the growth sector. A good number of quality names have been beaten up and deserve some notice.

The year-end results for 2022 should come out well. My focus is not on monthly, quarterly, or annual performance but on overall performance. My goal is to out-perform the market and I will continue to do just that.

A simple long-only model that is managed well can out-perform any fancy long-short model.

The A/X Growth Portfolio has 15 long-only positions.

-------------

Jan. 5, 2022

The A/X Growth Portfolio had a good year in 2021.

The portfolio returned 102.73%.

Source: TipRanks

Date: Dec. 31, 2021

-------------

Jan. 3, 2022

Happy New Year!

Time flies.

Every January or so, I will refresh the investment model. I will add or delete securities/cryptos.

Here are some Adds/Deletes.

Add: BioNTech

Delete: Moderna, Solana, Polkadot, and Cardano

BioNTech replaces Moderna, and the other cryptos may be added back later when they become more established. Going forward, I will only have growth names and no startups in the portfolio.