Roku: Outperform @ $128

Roku Update: Live Blog

July 29, 2020

Market Price: $148 (July 28, 2020)

Personal Buy Rating:

-Buy Light (buy some) @ Market Price

-Buy Medium (buy more) @ 20% Discount

-Buy Heavy (buy many) @ 50% Discount

--------------

July 14, 2020

Update:

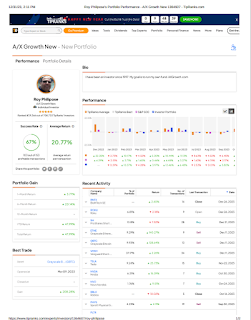

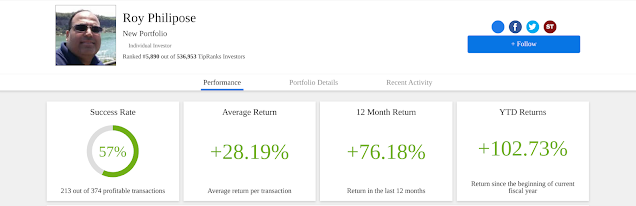

By Roy Philipose

Longer Term Outlook:

5 Year ~ $381

Basis: The company will grow at least 26% per year for the next 5 years. Therefore, the security will be worth 3.1x more than the fair value price of $120 a share.

Fair Value: $120

Fair value is the value based on growth prospects and the company going private.

Fair value is the value based on growth prospects and the company going private.

Comment:

Roku is a major distribution hub for online TV content. Eventually, I see them developing their own content, which would make them even more valuable.

---------------------

July 2, 2020

- Roy Philipose, Independent Analyst

Stock rating:

Outperform (Buy)

- Exceed S&P 500 (benchmark) over next 12 months.

Company

Pros:

Roku (ROKU) is an Internet based TV platform featuring free and premium content. Roku has a mobile app and they are the standard OS on many new television sets. Roku generates revenue with partnerships and ads in-between shows. They have established a TV guide on their channel and they continue to add new content. Roku is in a great position to capitalize in the shift from traditional TV advertising to Internet TV advertising. The company is growing and the outlook is strong. Anthony Wood is Roku's CEO.

- Roy Philipose, Independent Analyst

Stock rating:

Outperform (Buy)

- Exceed S&P 500 (benchmark) over next 12 months.

Roku: Outperform

Current Price: $128 (closing price, 7/1/2020)

Current Price: $128 (closing price, 7/1/2020)

Market Cap: $14B

Fair Value: $120

Target Price 12M: Unknown (short-term target prices are hard to predict)

Reason: Growth

Fair Value: $120

Target Price 12M: Unknown (short-term target prices are hard to predict)

Reason: Growth

Longer Term Outlook

10 Year Price Outlook: $1,200 by 2030

Basis: The company will grow at least 26% per year for the next 10 years. Therefore, the security will be worth 10x more than the fair value price.

10 Year Price Outlook: $1,200 by 2030

Basis: The company will grow at least 26% per year for the next 10 years. Therefore, the security will be worth 10x more than the fair value price.

Company

Pros:

Emerging Brand

Good Content

International Growth

TV Set Standard

Break-even to Profitable Operations

Cons:

Competition (Netflix or Amazon may enter TV ads business)

Disclosure: Long Roku

Disclosure: Long Roku

Disclaimer: Investments may lose value

Copyright © Roy Philipose 2020. All rights reserved.