Tesla: Outperform @ $1000

Tesla Update: Live Blog

------------------

Oct 21, 2020

Current Rating: Buy

Current Price: $422

12M Target Price: N/A

5Y Target Price: $1,165

Fair Value Price: $325

(Fair value is based on 7x 2021 Revenue of $35 Billion ($260 share value) plus 25% premium ($65 additional value) to take private)

Revenue Estimate: $35 Billion for 2021

(Estimate is based on Auto sales of 700K x ASP of $50K)

Outstanding Shares (Q3, 2020) : 937 Million

Comment

RE: Q3, 2020

The company released positive quarterly numbers and sales outlook. Topics discussed on the earnings call include: autonomy software feedback, autonomy being a major margin contributor in the future, improving product affordability, Megapack and solar being big next year, Tesla being a startup of startups, and Tesla's internal manufacturing expertise.

5 Year Target price of $1,165 is based on 35% compound growth rate.

(Fair value of $260 a share x 4.48 multiplier)

Based on the overall valuation and growth prospects, I have increased the fair value price to $325 a share.

--------------------

Sept 27, 2020

--------------------

Sept 23, 2020

Current Price: $424 (Sept 22)

12M Target Price: N/A

Fair Value Price: $262 (Fair value is based on a Forward P/S of 7)

Revenue Estimate: $35 Billion for 2021 (Estimate is based on Future Sales of 700K x ASP of $50K)

Comment:

The company recently had their shareholder and battery day. They announced innovations that would allow them to scale, bring down cost, and increase range. Due to these announcements, I have increased the current fair value price. Tesla, in whole, deserves a premium valuation versus the rest of the industry.

-------------------

Sept 3, 2020

Current Price: $447 (Sept 2, 2020)

12M Target Price: Unknown

Fair Value Price: $200

(Fair value is based on a forward P/E of 50 with 12m EPS of $3.20, plus 25% premium to take private.)

Comment:

Tesla had a recent 5 for 1 stock split. Tesla stock is currently overbought and will eventually correct itself. Our fair value price is unchanged at $200 and will be updated on a quarterly basis.

Recommendation:

1) Buy shares on any major dip

2) Dollar cost average on monthly basis

3) Buy puts to protect portfolio (optional)

Price Outlook:

3 Year ~ $492

5 Year ~ $896

10 Year ~ $4,021

Basis: Tesla will grow at least 35% per year for the next ten years. New product lines and expansion will add to that growth. Therefore, in three, five, and ten years the value of the company should be 2.4x, 4.4x, 20.1x respectively, more than the fair value price. Investing is all about the longer-term (5+ years). Tesla is still growing and positioned to outperform.

Rating:

Outperform (Maintain)

Buy Light (Personal)

----------------

July 29, 2020

Market Price: $1,476 (July 28, 2020)

Fair Value: $1,000 (Based on forward P/E of 50 with $16.00 EPS plus 25% premium to take private.)

Personal Buy Rating:

Personal Buy Rating:

-Buy Light (buy some) @ Market Price

-Buy Medium (buy more) @ 20% Discount

-Buy Heavy (buy many) @ 50% Discount

-----------------

July 25, 2020

Comment:

Q2 results came in better than expected, as the company beat analyst profit estimates. The company outlook is generally positive. Tesla is now eligible to join the S&P 500. On the earnings call, they discussed: manufacturing innovation and growth, Tesla Energy becoming big, Nickel mining, Tesla car insurance, Auto-pilot testing, local sourcing, gross margin improvements over time, and demand exceeding supply.

Market Price: $1,417 (July 24, 2020)

Fair Value: $1,000 (Basis: Overall company value and growth prospects)

Price Outlook:

3 Years ~ $2,460

Basis: Tesla will grow at least 35% per year. Therefore, in three years the value of the company should be 2.46x more than the fair value price. Investing is all about the longer-term (3-5 years). Tesla is still growing and positioned to outperform in that timeframe.

Rating:

Outperform (Maintain)

Buy Light (Personal)

-----------------

July 12, 2020

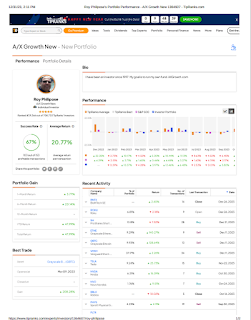

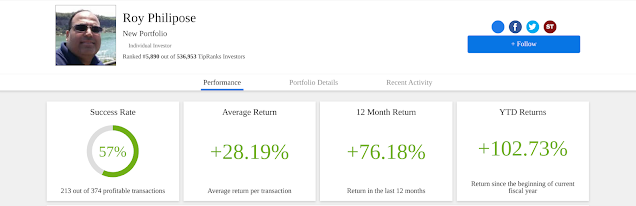

By Roy Philipose

Tesla: Outperform Rating

Market Price: $1,544 as of July 10, 2020

Fair Value: $800 (Based on a P/E of 60 and forward 12m EPS of $13.33)

Target Price 12M: Unknown (Short-term prices are hard to predict)

Earnings Outlook:

Forward 12m (Q3/20-Q3/21): $13.33 EPS

Longer Term Price Outlook:

5 year ~ $3,200

10 year ~ $13,000

Basis: The company will grow at least 32% per year for the next 5-10 years. Therefore, the security will be approximately worth 4x in 5 years and 16x in 10 years, based off of fair value price.

Comment:

Tesla stock is trading higher on higher Q2 sales, short-term speculation, and short-covering. There is also indication that the stock may enter the S&P 500 this year. Investors buying Tesla today will pay a huge markup to own it in the short-term. I recommend investors dollar-cost average and buy on a monthly basis. Tesla has been a high-risk, high-reward opportunity. So far, the stock has generated a 90x return since going public @$17 in June 2010.

----------------------------

June 29, 2020

Tesla (TSLA) is an automotive, battery, and solar manufacturer. They are a world-wide leader in the electronic vehicle space. Tesla cars are in demand and the company is generating cash on a regular basis. They are in a great position to capitalize on the shift from internal combustion engines to electronic drive and the shift from central energy production to distributed energy production. Tesla is growing and outlook for the company is strong. Elon Musk is Tesla's CEO.

- Roy Philipose, Independent Analyst

Stock ratings:

Outperform (Buy) = Exceed Benchmark (S&P 500) over next 12 months.

Hold (Neutral) = In Line with Benchmark " "

Underperform (Sell) = Underachieve Benchmark " "

Tesla (TSLA) is an automotive, battery, and solar manufacturer. They are a world-wide leader in the electronic vehicle space. Tesla cars are in demand and the company is generating cash on a regular basis. They are in a great position to capitalize on the shift from internal combustion engines to electronic drive and the shift from central energy production to distributed energy production. Tesla is growing and outlook for the company is strong. Elon Musk is Tesla's CEO.

- Roy Philipose, Independent Analyst

Stock ratings:

Outperform (Buy) = Exceed Benchmark (S&P 500) over next 12 months.

Hold (Neutral) = In Line with Benchmark " "

Underperform (Sell) = Underachieve Benchmark " "

Tesla: Outperform

Current Price: $1009 (closing price)

Current Price: $1009 (closing price)

Fair Value: $700

Target Price 12M: $1000 (Target prices are hard to predict)

Reason: Growth

Bear case: $500

Bull case: $1000

Target Price 12M: $1000 (Target prices are hard to predict)

Reason: Growth

Bear case: $500

Bull case: $1000

Earnings Outlook:

12M (Q3/20-Q3/21): $13.00

Personal Buy Ratings:

Buy Light @ $1000s (Normal risk with normal reward)

Longer Term Outlook

10 year: $10,000 by 2030

Company Pros/Cons:

Pros:

Buy Light @ $1000s (Normal risk with normal reward)

Buy Medium @ $700s (Less risk with more reward)

Buy Heavy @ $500s (Least risk with most reward)

Longer Term Outlook

10 year: $10,000 by 2030

Company Pros/Cons:

Pros:

Strong Demand

Quality Product

Generally Profitable

Cash Flow Positive

Environmentally Friendly

Employee Owners

Cons:

Elon Musk (company dependent)

Disclosure: Long Tesla

Cons:

Elon Musk (company dependent)

Disclosure: Long Tesla

Disclaimer: Investments may lose value

Copyright © Roy Philipose 2020. All rights reserved.