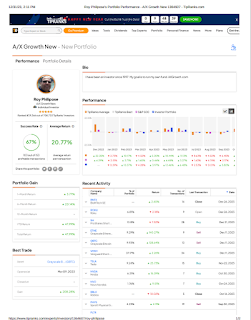

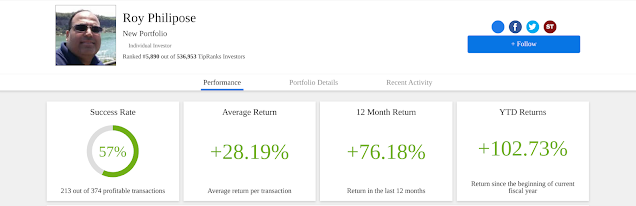

A/X Growth 2019: Update 4 - March 19, 2020

The stocks I like going forward are Tesla, Roku, and Beyond Meat. These growth companies are leaders in the field and continue to innovate.

Understanding Buy, Sell, and Hold Ratings...

1) Buy Recommendation: $82

11/6/2019 - Beyond Meat (BYND) is a plant-based manufacturer of meat products. They offer an alternative to traditional animal-based meats, while maintaining the look and taste. Beyond Meat is in a great position to capitalize on the shift from animal-based meat to plant-based meat products. There is growing trend to go healthy and to focus on the environment. They have set up partnerships with fast food chains and are in supermarkets. Recently, the stock came down and I see that as a buying opportunity.

1a) 3-17-2020 Beyond Meat: Outperform (Moderate Buy)

Current Price: $62

Target Price 12M: $80

Reason: Valuation

1b) 3-18-2020 Beyond Meat: Underperform (Moderate Sell)

Current Price: $60

Target Price 12M: $60

Reason: Market Conditions

1c) 3-19-2020 Beyond Meat: Hold (Neutral)

Current Price: $54

Target Price 12M: $65

Reason: Market Conditions

2) Buy Recommendation: $300

10/24/2019 - Tesla (TSLA) is auto, battery, and solar manufacturer. Recently, they came out with a positive outlook and earnings report. They have turned the corner regarding their issues and things should be more smooth going forward - sales are stable. Tesla is in a great position to capitalize on the shift from internal combustion engines to electronic drive and the shift from central energy production to distributed energy production. I see them having worldwide growth and introducing ride-sharing to balance any potential slowdown in USA.

2a) 3-17-2020 Tesla: Outperform (Moderate Buy)

Current Price: $440

Target Price 12M: $600

Reason: Valuation

2b) 3-18-2020 Tesla: Underperform (Moderate Sell)

Current Price: $430

Target Price 12M: $430

Reason: Market Conditions

2c) 3-19-2020 Tesla: Hold (Neutral)

Current Price: $372

Target Price 12M: $450

Reason: Market Conditions

Understanding Buy, Sell, and Hold Ratings...

1) Buy Recommendation: $82

11/6/2019 - Beyond Meat (BYND) is a plant-based manufacturer of meat products. They offer an alternative to traditional animal-based meats, while maintaining the look and taste. Beyond Meat is in a great position to capitalize on the shift from animal-based meat to plant-based meat products. There is growing trend to go healthy and to focus on the environment. They have set up partnerships with fast food chains and are in supermarkets. Recently, the stock came down and I see that as a buying opportunity.

1a) 3-17-2020 Beyond Meat: Outperform (Moderate Buy)

Current Price: $62

Target Price 12M: $80

Reason: Valuation

1b) 3-18-2020 Beyond Meat: Underperform (Moderate Sell)

Current Price: $60

Target Price 12M: $60

Reason: Market Conditions

1c) 3-19-2020 Beyond Meat: Hold (Neutral)

Current Price: $54

Target Price 12M: $65

Reason: Market Conditions

2) Buy Recommendation: $300

10/24/2019 - Tesla (TSLA) is auto, battery, and solar manufacturer. Recently, they came out with a positive outlook and earnings report. They have turned the corner regarding their issues and things should be more smooth going forward - sales are stable. Tesla is in a great position to capitalize on the shift from internal combustion engines to electronic drive and the shift from central energy production to distributed energy production. I see them having worldwide growth and introducing ride-sharing to balance any potential slowdown in USA.

2a) 3-17-2020 Tesla: Outperform (Moderate Buy)

Current Price: $440

Target Price 12M: $600

Reason: Valuation

2b) 3-18-2020 Tesla: Underperform (Moderate Sell)

Current Price: $430

Target Price 12M: $430

Reason: Market Conditions

2c) 3-19-2020 Tesla: Hold (Neutral)

Current Price: $372

Target Price 12M: $450

Reason: Market Conditions

3) Buy Recommendation: $130

10/24/2019 - Roku (ROKU) is a subscription based Internet TV platform featuring various free and premium content. They have a mobile app and they are becoming the standard OS on many new television sets today. Roku generates revenue with partnerships and ads in between shows, and they continue to add new content. Roku is in a great position to capitalize in the shift from traditional tv advertising to Internet tv advertising. In the event of a recession, people will still watch television thru Roku.

3a) 3-17-2020 Roku: Buy (Strong Buy)

Current Price: $60

Target Price 12M: $100

Reason: Valuation

3b) 3-18-2020 Roku: Outperform (Moderate Buy)

Current Price: $69

Target Price 12M: $80

Reason: Market Conditions

Disclosure: Long TSLA, ROKU, BYND

Disclaimer: Investments may lose value

- Roy Philipose

10/24/2019 - Roku (ROKU) is a subscription based Internet TV platform featuring various free and premium content. They have a mobile app and they are becoming the standard OS on many new television sets today. Roku generates revenue with partnerships and ads in between shows, and they continue to add new content. Roku is in a great position to capitalize in the shift from traditional tv advertising to Internet tv advertising. In the event of a recession, people will still watch television thru Roku.

3a) 3-17-2020 Roku: Buy (Strong Buy)

Current Price: $60

Target Price 12M: $100

Reason: Valuation

3b) 3-18-2020 Roku: Outperform (Moderate Buy)

Current Price: $69

Target Price 12M: $80

Reason: Market Conditions

Disclosure: Long TSLA, ROKU, BYND

Disclaimer: Investments may lose value

- Roy Philipose