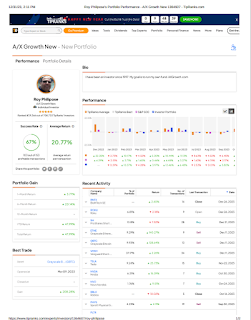

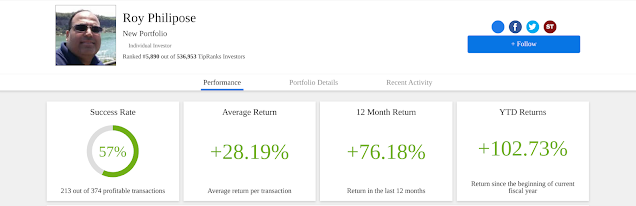

A/X Portfolio 2015

by Roy "Dr. P" Philipose

Over the years I have developed an "investment model" which has done well. I continue to learn and get better with the model over time. I use a "10 step method" in evaluating companies. A book I recommend adding to your library, if you haven't already, is Common Stocks and Uncommon Profits by Philip Fisher. It is an easy-to-read book, similar to books written by Peter Lynch.

"10 Step Method"

-- Stock Picking, Major Factors

1, Good Management (Ceo)

2, Growing Revenue

3, Cashflow Generation

4, Competitive Edge (Leader)

5, Little or No Debt

6, Inside Ownership (Founder)

7, Safety of Margin (20%)

8, Favorable Risk/Reward

9, Fundamental Catalyst

10, Popular Factor (Need)

--------------

A/X Portfolio

Here is an open list of 10-20 stocks that are part of the "A/X" portfolio. You can see the many "major factors" present in the companies listed. Overall, most of the stock picks have done well, and should continue to do well. There are some stocks that haven't done well, and they have been downgraded to the "B" portfolio.

One key to successful investing is to buy good companies when their stock price sharply declines.

Personally, I like the FATS (Facebook, Apple, Tesla, SolarCity) portfolio.

1) FB - recommended since $24

2) AAPL - recommended since $62

3) TSLA - recommended since $35

4) SCTY - recommended since $16

5) AMZN, Amazon

6) GOOGL, Google

7) LC, Lending Club

8) LNKD, LinkedIn

9) NFLX, Netflix

10) PHYS, Physical Gold

11) PLNT, Planet Fitness

12) SHAK, Shake Shack

13) TWTR, Twitter

14) UA, Under Armour

15) ZG, Zillow

16) BTCUSD=X, Bitcoin (Added Dec 2015)

Disclosure: Long Recommendation

© Copyright 2015 Roy Philipose. All rights reserved.

Over the years I have developed an "investment model" which has done well. I continue to learn and get better with the model over time. I use a "10 step method" in evaluating companies. A book I recommend adding to your library, if you haven't already, is Common Stocks and Uncommon Profits by Philip Fisher. It is an easy-to-read book, similar to books written by Peter Lynch.

"10 Step Method"

-- Stock Picking, Major Factors

1, Good Management (Ceo)

2, Growing Revenue

3, Cashflow Generation

4, Competitive Edge (Leader)

5, Little or No Debt

6, Inside Ownership (Founder)

7, Safety of Margin (20%)

8, Favorable Risk/Reward

9, Fundamental Catalyst

10, Popular Factor (Need)

--------------

A/X Portfolio

Here is an open list of 10-20 stocks that are part of the "A/X" portfolio. You can see the many "major factors" present in the companies listed. Overall, most of the stock picks have done well, and should continue to do well. There are some stocks that haven't done well, and they have been downgraded to the "B" portfolio.

One key to successful investing is to buy good companies when their stock price sharply declines.

Personally, I like the FATS (Facebook, Apple, Tesla, SolarCity) portfolio.

1) FB - recommended since $24

2) AAPL - recommended since $62

3) TSLA - recommended since $35

4) SCTY - recommended since $16

5) AMZN, Amazon

6) GOOGL, Google

7) LC, Lending Club

8) LNKD, LinkedIn

9) NFLX, Netflix

10) PHYS, Physical Gold

11) PLNT, Planet Fitness

12) SHAK, Shake Shack

13) TWTR, Twitter

14) UA, Under Armour

15) ZG, Zillow

16) BTCUSD=X, Bitcoin (Added Dec 2015)

Disclosure: Long Recommendation

© Copyright 2015 Roy Philipose. All rights reserved.